QIHU was a bounce trade that I took recently. It got smacked hard by short sellers because of a negative report by Citronresearch.com. While QIHU isn’t priced below $5.00 per share like most penny stocks when a site like Citronresearch calls fraud on a company, the stocks of real companies can become very volatile like penny stocks and this is the reason why I traded it. I like volatility because it allows stocks to move to my target prices quickly when specific trading patterns setup. These articles sometimes can cause stocks to drop a large amount so I usually look for opportunities to buy the stocks after they have moved too far too fast. Since many traders short these alerts by citronresearch.com, naturally the smart ones will look to cover their positions eventually. This will cause a short term spike in the stock, which combined with bounce players like myself (buyers), can cause a large spike. I usually end up “stalking” a stock for several hours or even a few days, for the perfect time to buy them for a scalp. Bounce trades are one of my favorite trades because I have seen a specific setup so many times and I know it continues to repeat over and over again. For this reason, I am confident to “catch a falling knife” since I know about 75% of the time I will have a pair of protective gloves that will prevent me from getting hurt. The other 25% of the time I have my software-based stop-loss to protect me. Money management plays a huge part in trading because if you don’t cut off your losing trades, you’ll surely end up the biggest loser. The lack of proper money management is the reason why 95% of people fail at timing the market.

QIHU was a bounce trade that I took recently. It got smacked hard by short sellers because of a negative report by Citronresearch.com. While QIHU isn’t priced below $5.00 per share like most penny stocks when a site like Citronresearch calls fraud on a company, the stocks of real companies can become very volatile like penny stocks and this is the reason why I traded it. I like volatility because it allows stocks to move to my target prices quickly when specific trading patterns setup. These articles sometimes can cause stocks to drop a large amount so I usually look for opportunities to buy the stocks after they have moved too far too fast. Since many traders short these alerts by citronresearch.com, naturally the smart ones will look to cover their positions eventually. This will cause a short term spike in the stock, which combined with bounce players like myself (buyers), can cause a large spike. I usually end up “stalking” a stock for several hours or even a few days, for the perfect time to buy them for a scalp. Bounce trades are one of my favorite trades because I have seen a specific setup so many times and I know it continues to repeat over and over again. For this reason, I am confident to “catch a falling knife” since I know about 75% of the time I will have a pair of protective gloves that will prevent me from getting hurt. The other 25% of the time I have my software-based stop-loss to protect me. Money management plays a huge part in trading because if you don’t cut off your losing trades, you’ll surely end up the biggest loser. The lack of proper money management is the reason why 95% of people fail at timing the market.

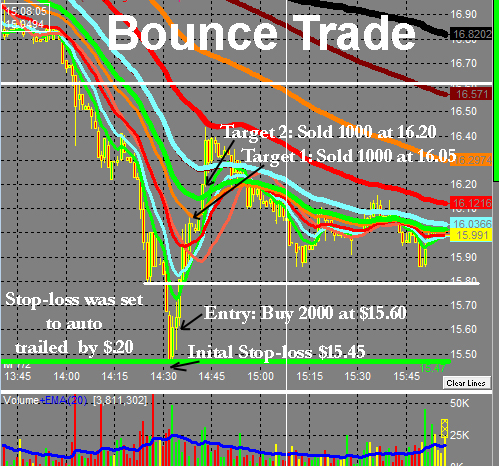

I bought 2000 shares of QIHU when my technical trading system – which I refer to as the “Buy / Sell Zones” – told me it was time. I only buy into these high probability setups where the risk/reward results in $.50-1.00 of upside with $.25-.35 downside or for lower price stocks a risk-reward of 3:1 or 4:1. I sold 1000 shares into my first target in 6 minutes at $16.05. I sold 1000 shares into my second target at $16.20 in about 11 minutes. Usually, the trades play out in minutes, and other times they take an hour or two. I rarely hold for longer than that on a bounce trade. Sometimes I will only sell 1/3 of my position into each target and instead hold the remaining 1/3 with a trailing stop, but this time I had to leave early, so I opted for selling 1/2 at each target. When I have a pretty good trade like this I usually stop for the day especially when the trade happens later in the day since most of the day is what I refer to as the no-trade zone. I find if I trade between 11:00 – 2:30 without a significant catalyst I will most likely lose money.

For bounce trades, I like to use a specific type of moving average set on various periods. Everything I use is non-standard so there aren’t any 50 or 200 SMA’s on my chart or anything else like that that you read about in technical analysis books. I find “the herd” looks at these standard indicators and the herd is always wrong, so I don’t want to trade with them. While these standard MAs certainly can act as support or resistance they usually result in a lot of price noise which makes them pretty much useless in my opinion. As I mentioned entries come from my proprietary Buy / Sell Zone setup which is a group of technical indicators that must align for me to consider taking a trade. Moving averages are just a tiny piece of the puzzle which I use in my trading. If you are interested in learning more keep checking this page or else visit my website Beatstockpromoters.com to purchase my trading guide.