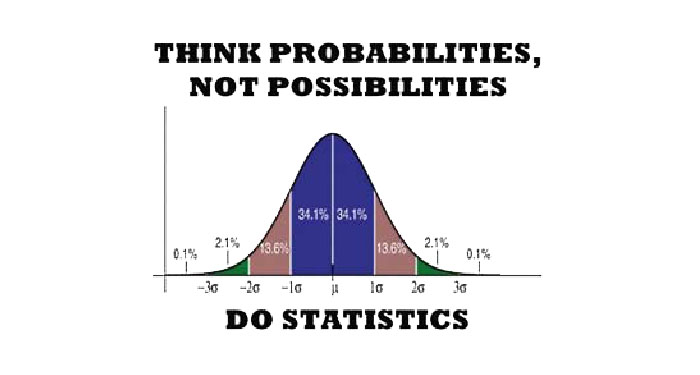

Knowledge and experienced-based guessing are what results in a positive expectancy in the market and in trading hot penny stocks. I have a statistical edge because of this but you must understand what that actually means. It does not mean I make money every time and it does not mean it will work forever, but on average my net winning trades are greater than my net losing trades, and my strategy has worked for quite a while and will most likely continue to work.

Basically, I have identified a series of patterns that result in an asset doing what I expect it will do more often than it does not. Backtesting is how I initially identify a statistical edge which is what I did before I traded with real money and what I do when I am looking for a new strategy to trade a different market. When trading stocks without leverage (margin) you only need to be right more than 50% of the time to make money. In leveraged assets, you can be correct only 30% of the time and still make money.

Trading Stocks or Penny Stocks

I place 10 trades and I win on 6 of them. On the winning trades, I make at least 3 times what I make on the losing trades so my reward to risk is 3 to 1. For example, on the winning trades, I make $1500 (3 times my loser) times 6 trades = $8000. My net profit is $6000 but I was only correct 60% of the time. On the losing trades, I lose $500 per trade times 4 trades = net loss of $2000. I use stop losses and defined profit targets and trade using a semi-automated system to insure emotion doesn’t play a part in my decisions. That’s how the money management I use works and that’s how I can be sure I have a statistical edge.

Trading: Futures, Options, Forex

Now when you trade futures where the inherent leverage is 10x, if I make sure my reward to risk is at least 5:1, I can lose on 7 trades ($500 loss per trade) = $3500 loss and then on the 3 winning trades I make $2500 per trade, which equals $7,500 profit and therefore results in $4000 net profit. I make money even though I am only right 30% of the time. All it takes is identifying one little pattern that repeats itself. That’s all you need to make money consistently in the market. There’s no holy grail in trading like people are looking for with some magical trading system that wins 100% of the time but trading on stock tips, message board postings, or out of the gut is just foolish.

The market Is 100% Random?

From my experience, the market isn’t random. It is made up of the buying and selling decisions of people who all look at the same data either fundamental or technical, and now in current years computers (HFT) market-making systems, which are programmed with specific patterns. Yes, some factors are random and a trader has no control over, such as whether a company will miss earnings or when a buyout will be announced. Nobody can predict this without insider trading which obviously isn’t a part of a real trading system accept for maybe crooked hedge funds like SAC Capital. That is coin flip odds when you are involved in that sort of thing. The only way to factor these in is to avoid trading the actually earnings release and shortening holding periods.

What I Trade:

I trade penny stocks and higher-priced stocks along with other asset classes. The system I use works for any asset, not just stocks, but I have a specific strategy just for trading penny stocks and other strategies for higher-priced stocks. Penny stocks are not scalable so you can only throw so much at them accept when you have trade setups like FNMA a few weeks ago which traded 1 billion dollars of volume but that’s unusual. In higher-priced stocks, although I can trade a stock like AAPL or GOOG, I prefer to trade stocks that are less well known, but still liquid enough where I can pull a $1000-5000 profit and not have the market know what hit them.

I couldn’t dump $30 million into the stocks I like to trade like you can into AAPL or GOOG but the competition is just too high in something like GOOG where institutional traders have hundreds of millions of dollars in bankrolls and can therefore accept much larger drawdowns and outlast individual traders. You certainly can make money in GOOG and AAPL but you need a ton more money. I trade with a large account and I stay away from those tickers, so people trading with $1,000 or even $10,000 have no shot. The same is true for penny stocks where people try to trade with $500 or less and think they can be successful but this is not true.

Want to get started? Click here